If your business is struck by fire, flood or explosion it need not be the end of the world, writes Bob Serafini

If you have spent the past 10, 15 or 20 years building up a business, there’s a good chance that your focus will be entirely on expansion and developing new products. You will be aware that disaster could strike but as your head touches the pillow it is not consumed with thoughts of fire, impact damage, explosions or flood. You know that you are insured, Charlie your mate from the golf club has looked after that for you. But suppose the unthinkable happens, suppose your premises are struck by lightning and there’s an explosion that destroys in three hours the fruits of 15 years’ labour?

As you survey the burnt out shell of your small factory and see the charred remains of machinery it would be handy if you had a magic wand. Unfortunately they and genies are the prevalence of fairy tales and a more practical route has to be taken.

Colin Dair is a director with CRGP and over the years he has become a specialist in what to do when a disaster strikes a business. He has regularly been the first person on a site after the services have left. He has waded through premises affected by flooding, scanned the grim aftermath of gas explosions, inspected the burnt-out shells of warehouses, night clubs, hotels, pubs and nursing homes.

His expertise is called upon by the owner of a business or property to estimate the damage and begin a reinstatement programme. The insurance company will be involved and so too will the loss adjuster; they will work together to reach an agreed plan of action.

Every job has its unique features and as Dair surveys each depressing scene his mind is already working on a recovery plan, he is formulating a reinstatement programme while recognising the chance of further damage or perhaps the possibility of limited production commencing.

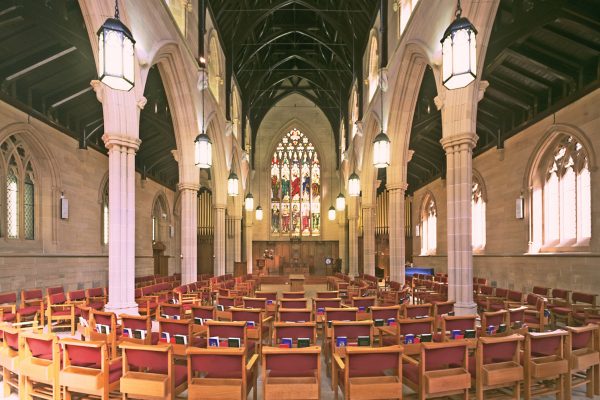

“It is important for most business to get up and running again as soon as possible,” says Dair. “Last year we represented a client whose laminate floor company suffered serious damage as the result of fire. The complete front of the warehouse, which contained the offices was destroyed but the rear of the building was intact.

“In this case it was a fairly straightforward procedure to consult with the various interested parties and put forward our plans for a reinstatement that would create the minimum upset to trading.”

Although every circumstance is different the same rules and procedures are followed whether it is the pie man or paper clip manufacturer’s business that is interrupted. In the short term there are many ways where a business can be continued without having the factory rebuilt.

Getting a business moving again as soon as possible is the main criterion and it is not always plain sailing.

Last year CRGP was called in following a chemical fire at a small factory in East Kilbride. The fumes from the fire affected the plant and it was Dair’s job to keep the company in production without loss of continuity. It operated in a niche market that was part of the massive IT industry, making tiny copper parts that are found in the mobile phone. Indeed its whole weekly production could be put in a Transit van.

Once it was considered safe to go in, Dair and his team (usually a building surveyor and architect), entered the building to estimate the damage and establish a plan of action.

“The whole place was blacked by smoke and in conjunction with the loss adjuster, one of the first things we did was to engage the services of a specialist cleaning company to ensure that all chemical residue was cleared up and that the machine tools had not been affected by any acidic attack,” said Dair.

“Fortunately three of the four production lines were not too seriously damaged and our next challenge was to come up with a solution that would allow the roofing sheets to be renewed while production continued below.

“We installed a sealed crash deck scaffold so that repair work could be carried out without any dust or debris falling on to the production line. In three days we had production back to a reasonable level and in four months all repair work had been completed, which of course greatly pleased the insurance company.”

Although all may seem lost following a fire, flood or explosion, owners of companies struck by calamity may feel a little more comfortable knowing that people such as Colin Dair and his team liaising with insurance companies and loss adjusters know what to do to get you back in business. It isn’t quite a magic wand but it is the next best thing.